Presley

Sale Finalized

|

The

sale of "EPE" has been finalized.

This

is the information from PR Newswire.

|

|

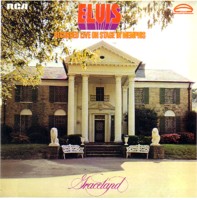

Sports

Entertainment Enterprises, Inc. (OTC Bulletin Board: SPEA) announced

today that it had consummated the previously announced transaction

pursuant to which RFX Acquisition LLC, an entity formed and

controlled by Robert F.X. Sillerman, acquired a controlling

interest in the Company. That transaction was closed simultaneous

with the Company's acquisition of an 85% interest in entities

that own the name, image and likeness of Elvis Presley and own

or have the right to use and benefit from the Graceland mansion

and related attractions, as well as other assets and revenue

streams associated with Elvis Presley and Graceland.

The

Company is presently conducting business under the name "CKX"

and will seek shareholder approval to change the name of the

Company to "CKX, Inc."

The Presley acquisition is the first acquisition in the Company's

plan to acquire, control, develop and build content in various

forms of media. The Company's business plan is to make selective

and strategic acquisitions of, or partner with, individuals

or companies that control various forms of established or

developable content.

Thereafter,

the Company will seek to improve and enhance the development

and marketing of such content. The Company will also seek

to capitalize on the increasing distribution opportunities

that make it easier and less costly to deliver content to

consumers and which enable consumers to selectively decide

how, when and where they will consume content. Commenting

on the acquisition, Mr. Sillerman said, "We are excited to

launch CKX with our investment in the Presley assets. I can

think of no better way to introduce our artist-centered business

than to reintroduce Elvis Presley in this digital age, including

enticing opportunities in Las Vegas and outside the United

States. CKX will be all about partnering with the finest creative

talent as the methods of distribution of entertainment continue

to evolve. The old model, in which a few decision makers tell

consumers what they can see or hear, and how, when and where

they can see or hear it, is quickly disappearing. In the coming

months and years, CKX hopes to partner with or acquire developable

or already developed content as we align ourselves with the

creators of content."

On

a combined and audited basis, the Presley businesses had total

revenue of $44.4 million for the twelve months ended December

31, 2003, and $32.4 million for the nine months ended September

30, 2004. Operating income for those periods was $10.8 million

and $7.3 million, respectively.

Operating

income for the respective periods includes depreciation and

amortization expense of $1.2 million and $0.9 million, respectively.

As previously announced, RFX Acquisition (i) contributed $3,046,407

in cash to SPEA in exchange for 30,464,072 newly issued shares

of Common Stock; (ii) received 20,485,817 two-year warrants

to purchase shares of Common Stock at between $1.00 and $2.00

per share and (iii) acquired an aggregate of 2,240,397 shares

of Common Stock directly from certain principal stockholders

of the Company at the same price of $0.10 per share.

Mr.

Sillerman and other members of senior management immediately

exercised an aggregate of five million of the $1.00 warrants.

Following the closing of the transactions, Mr. Sillerman and

other members of the Company's senior management beneficially

own an aggregate of approximately 66% of the outstanding Common

Stock and approximately 61% of the fully diluted Common Stock

of the Company, after giving effect to the exercise of all

outstanding warrants and the conversion of all outstanding

shares of preferred stock.

Pursuant

to a Contribution and Exchange Agreement dated December 15,

2004, by and among the Company, The Promenade Trust and RFX

Acquisition, the Trust contributed 85% of the outstanding

equity interests of the Presley business to the Company and

in exchange received, from the Company $50.1 million in cash,

1,491,817 shares of Series B Convertible Preferred Stock,

one share of Series C Convertible Preferred Stock and 500,000

shares of Common Stock of the Company.

In

addition, at closing, the Company paid off approximately $25.1

million of outstanding indebtedness of the Presley business.

The Trust continues to own 15% of Presley business.

Each

share of Series B Preferred Stock has a stated value of $15.30,

is convertible into one share of Common Stock at a price of

$15.30 per share, subject to customary anti-dilution adjustment,

and entitles the holder to receive an annual dividend calculated

at a rate of 8% of the stated value. The Company also acquired

additional commercial rights to the "Presley" name from Priscilla

Presley, for a purchase price of $6.5 million.

The

Huff Alternative Fund, L.P. and an affiliate invested $44.8

million in cash in exchange for 2,172,400 shares of Series

A Convertible Preferred Stock, 3,706,052 shares of Common

Stock, and two-year warrants to purchase 5,581,981 shares

of Common Stock at between $1.00 and $2.00 per share Each

share of Series A Preferred Stock has a stated value of $20.00

per share and is convertible into shares of Common Stock.

The

conversion price of the Series A Preferred Stock, which, following

closing is $7.18 per share (approximately 2.8 shares), is

subject to adjustment upon certain issuances or exercises

of Common Stock or securities convertible into or exchangeable

for Common Stock at a price below $10.00 per share. The Company

also financed a portion of the cash consideration for the

Presley acquisition with a $39.0 million short-term senior

loan from an affiliate of Bear, Stearns and Co. Inc.

The

term of the loan is one year. Mr. Sillerman was the founder,

a major shareholder and served as Executive Chairman of SFX

Entertainment from its inception in 1997 until its sale to

Clear Channel Communications in August 2000. SFX Entertainment

was the largest presenter, promoter and producer of live entertainment

in the world.

Prior

to that, Mr. Sillerman was a founder, major shareholder and

served as Executive Chairman of SFX Broadcasting, a major

owner and operator of radio stations, from its inception in

1992 through its sale in 1998 to an affiliate of buyout firm

Hicks, Muse, Tate & Furst. For more detailed information see

our Current Report on Form 8-K, which may be obtained at the

SEC's web site at http://www.sec.gov. This document includes

certain forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995.

These

statements are based on management's current expectations

or beliefs, and are subject to uncertainty and changes in

circumstances. Actual results may vary materially from those

expressed or implied by the statements herein due to changes

in economic, business, competitive, technological and/or regulatory

factors, acquisitions of dispositions of business assets,

and the potential impact of future decisions by management

that may result in merger and restructuring charges, as well

as the potential impact of any future impairment charges to

goodwill or other intangible assets.

More

detailed information about these factors may be found in filings

by Sports Entertainment Enterprises, Inc. with the Securities

and Exchange Commission.

Sports

Entertainment Enterprises, Inc. is under no obligation to,

and expressly disclaims any such obligation to, update or

alter its forward- looking statements, whether as a result

of new information, future events, or otherwise.

(Sale

of EPE, Source: Business Wire, 7 Feb 2005)

|